The artificial intelligence revolution has, in essence, converted the way investors analyze enterprise software opportunities. The artificial intelligence revolution has, in essence, converted the way investors analyze enterprise software opportunities. B2B SaaS AI Investment Criteria startups have generated so much attention and money that their funding is a record, while they assure to transform the industries through intelligent automation and data-driven insights.

What is the difference between those that are acquired and those that are completely forgotten? Getting a clear picture of the B2B SaaS AI Investment Criteria that influence investor decisions is vital for the growth of both the founders who are seeking capital and for the investors who are eager to find out tomorrow’s market leaders.

Table of Contents

Why Investors Are Turning to B2B SaaS AI Investment Criteria for Startups

Don’t be mistaken: the incredible demand for B2B SaaS AI investment is not empty talk but has a lot of strong market drivers behind it. According to the market survey, machine learning based enterprise software providers are consistently showing substantial customer acquisition gains and better competitive ability over common SaaS platforms.

Moreover, we can see from the recent market stats that B2B SaaS AI Investment Criteria startups can boast of a 40% faster rate of revenue growth than their counterparts working without AI. This gap in capability causes the investors to run around searching for the next set of smart enterprise solutions.

The combination of AI and repeatable software payment, on the one side, and the ability to provide certain ROI, has become the most preferred investment opportunity. The fact that Salesforce and HubSpot have already received the approval of their AI tools as being customer value-driving and a sustainable business model is strong proof of the potential of artificial intelligence.

Growth of B2B SaaS AI Investment (2019-2024)

| Year | Investment Volume | Growth Rate |

| 2019 | $4.2B | — |

| 2020 | $6.8B | 62% |

| 2021 | $12.4B | 82% |

| 2022 | $18.7B | 51% |

| 2023 | $24.3B | 30% |

| 2024 | $31.2B | 28% |

Opportunity Delineation: Market Demand and Future Prospects

Before delving into the intricacies of a product, astute investors begin by analysing the market size. As more sectors realise automation’s ability to resolve enduring operational difficulties, the total addressable market for B2B SaaS AI solutions keeps growing.

Effective B2B SaaS AI Investment Criteria continue to be based on product-market fit. Startups need to show that they are solving real problems that cost companies a lot of money or effort. The most financially viable businesses address issues that CEOs worry about, not luxuries.

Customer interviews are only one aspect of market validation. Early revenue traction, pilot program outcomes, and unmistakable proof that consumers would pay more for AI-powered products are what investors are looking for. The most successful startups can clearly explain how their technology produces quantifiable commercial results.

Market Size Projections by B2B SaaS AI Category

| Category | 2024 Market Size | 2027 Projection | Growth Rate |

| Sales Automation | $8.4B | $15.2B | 22% |

| Customer Service | $6.7B | $12.8B | 24% |

| HR & Recruiting | $4.1B | $8.9B | 29% |

| Finance & Accounting | $3.8B | $7.4B | 25% |

| Marketing Analytics | $5.2B | $9.6B | 23% |

The Team Behind the Code: Founders, Talent, and Agility

The team’s level of expertise often determines whether a B2B SaaS AI Investment Criteria startup succeeds or fails. Investors favour founder teams that bring together a wealth of technical know-how with business acumen and industry experience. The ideal leadership profile includes knowledge of enterprise software, proficiency with AI/ML, and a history of expanding companies.

In AI firms, technical depth is crucial. Investors are looking for teams that understand data engineering, machine learning techniques, and the complexities of enterprise software architecture. Technical prowess alone, however, is insufficient; the group also has to have market awareness and client empathy.

Adaptability is becoming increasingly important as AI technology advances rapidly. The most successful teams make quick adjustments as market conditions change, iterate depending on client feedback, and continuously improve their AI models. Investors are looking for evidence of this adaptability in the founding team’s background.

Team Attributes vs. Startup Success Rate

| Team Attribute | Success Rate | Investor Priority |

| Prior AI Experience | 78% | High |

| Enterprise Software Background | 71% | High |

| Domain Expertise | 69% | Medium |

| Previous Startup Experience | 62% | Medium |

| Technical Leadership | 82% | High |

From Creativity to Integration: What Sets Technology Apart

In B2B SaaS AI Investment Criteria, unique technology that is hard to imitate gives businesses a competitive edge. Investors assess whether businesses have produced original algorithms, amassed significant datasets, or devised novel solutions to everyday issues. Protecting intellectual property becomes essential for preserving a competitive edge over time.

Whether a firm can expand from servicing dozens to thousands of enterprise clients depends on the scalability of its technology. Without experiencing a decline in performance, the underlying infrastructure must manage growing data quantities, user demands, and feature complexity. The technical architecture’s capacity to facilitate quick growth is closely examined by investors.

Adoption of B2B SaaS AI is frequently made or broken by integration capabilities. Instead of needing total system redesigns, enterprise clients choose solutions that integrate easily with current software ecosystems. User experience consistency, data interoperability, and API design are given top priority by the most prosperous startups.

Feature Comparison: Innovative vs. Standard SaaS Platforms

| Feature | Innovative AI SaaS | Standard SaaS |

| Predictive Analytics | Advanced ML models | Basic reporting |

| Automation Level | 80-90% | 30-40% |

| Data Processing | Real-time insights | Batch processing |

| Customization | AI-driven personalization | Manual configuration |

| Innovation Potential | Continuous learning | Static functionality |

The Business Engine: Revenue Models and Scaling Strategies

A sustainable business model is crucial for long-term success and attracting investment in B2B SaaS AI startups. Investors look for clear monetization strategies that closely align with the value delivered to customers. Common revenue models include subscription tiers offering predictable income, usage-based pricing that scales with customer consumption, and hybrid models combining fixed and variable charges to cater to diverse client needs.

Effective customer acquisition strategies are equally important, with investors focusing on scalability and efficiency. Key metrics such as customer acquisition cost, sales cycle duration, and potential for product-led growth are analyzed to assess unit economics.

Startups that demonstrate decreasing acquisition costs alongside increasing customer lifetime value signal strong growth potential. Moreover, consistent revenue growth, especially monthly recurring revenue (MRR) growth rates exceeding 15%, is often a key indicator of product-market fit and attracts significant investor interest. Ultimately, a balanced approach to revenue generation and scalable customer acquisition drives business model sustainability and investor confidence.

You need to read : FintechZoom.com Nickel Market: Insights & Investment Options

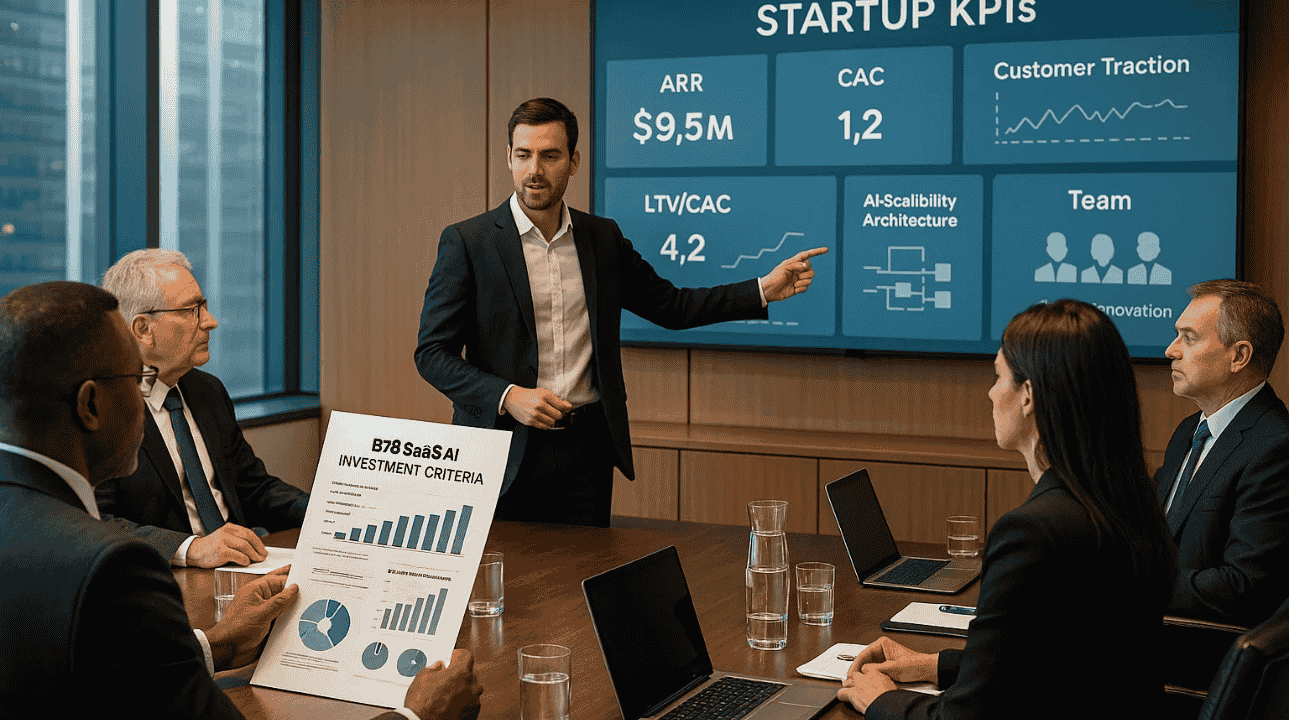

Measuring Success: Financial Forecasts and Key Metrics

Validation metrics provide objective evidence of startup performance and potential. Key performance metrics that show traction, efficiency, and growth trajectory are of interest to investors. SaaS assessment is based on client attrition rates, monthly recurring income, and annual recurring revenue.

Financial health encompasses more than just income; it also includes runway, capital efficiency, and burn rate. Better unit economics, restrained expenditure, and obvious routes to profitability are what investors want to see. The most successful businesses show that they can expand sustainably without needing a large initial investment.

Funding history reveals company execution skills and investor confidence. Prior rounds of successful financing, particularly from respectable investors, confirm the company’s idea and offer social proof. Investors do, however, also assess whether prior investment was used efficiently to accomplish significant milestones.

Key SaaS Metrics Investors Monitor at Different Stages

| Stage | Primary Metrics | Target Benchmarks |

| Pre-seed | Product-market fit signals | 10+ pilot customers |

| Seed | ARR, customer growth | $100K ARR, 20% MoM growth |

| Series A | Revenue growth, unit economics | $1M ARR, LTV/CAC > 3x |

| Series B | Market expansion, efficiency | $10M ARR, sustainable growth |

Navigating the Funding Maze: Stages, Options, and Strategy

When it comes to SaaS investment, B2B AI companies at different stages have several options. Pre-seed funding typically comes from angel investors, accelerators, or founder networks, focusing on team and early product validation. Seed rounds involve venture capital firms evaluating market opportunity and initial traction.

Series A funding requires demonstrating scalable business models and significant customer adoption. Investors at this stage scrutinize revenue growth, market expansion potential, and competitive positioning. The due diligence procedure gets increasingly thorough, looking into anything from consumer contracts to intellectual property.

SaaS firms are increasingly turning to other funding sources. Revenue-based financing allows companies to raise capital without diluting equity, while venture debt financing provides additional runway between equity rounds. Some startups explore government grants or strategic partnerships to fund specific development initiatives.

Stages of SaaS Funding and What Each Entails

| Stage | Typical Amount | Key Requirements | Investor Focus |

| Pre-seed | $250K-$1M | MVP, early customers | Team, vision |

| Seed | $1M-$5M | Product-market fit | Traction, market |

| Series A | $5M-$15M | Scalable growth | Business model |

| Series B | $15M-$50M | Market leadership | Expansion potential |

Future Outlook: Trends, Investor Priorities, and Strategic Steps

The B2B SaaS AI Investment Criteria landscape continues evolving as technology advances and market needs shift. Investors increasingly prioritize startups that demonstrate ethical AI practices, data privacy compliance, and transparent algorithmic decision-making. These factors are becoming as important as technical capability and market potential.

Industry disruption opportunities remain abundant across sectors like healthcare, finance, and manufacturing. Investors seek startups that can leverage artificial intelligence to solve industry-specific problems while maintaining business model sustainability. The most attractive opportunities combine a large market size with clear regulatory pathways.

Emerging trends include edge AI computing, explainable AI for enterprise applications, and AI-powered cybersecurity solutions. Investors are particularly interested in startups that can deliver AI capabilities without requiring extensive technical expertise from end users. The democratization of artificial intelligence represents a massive market opportunity.

Timeline: SaaS Investment Evolution and Upcoming Industry Shifts

- 2025: Focus on AI transparency and explainability

- 2026: Edge computing integration becomes standard

- 2027: Regulatory compliance drives investment decisions

- 2028: AI-first business models dominate new funding

Conclusion

The B2B SaaS AI Investment Criteria require a thorough understanding of market dynamics, technical capabilities, and business fundamentals. Successful startups must demonstrate strong team expertise, innovative technology, sustainable business models, and clear market validation. Focusing on these early in development increases funding success probability and helps investors identify startups with significant returns and market impact.

The revolution in corporate software due to artificial intelligence is just getting started. Companies will be in the greatest position to take advantage of the huge opportunities that lie ahead if they can grasp these investment criteria.

Frequently Asked Questions

1. What are the most important B2B SaaS AI Investment Criteria startup requirements?

The most important criteria are the market’s size and development potential, the team’s expertise in AI and enterprise software, competitively attractive proprietary technology, a long-term business plan, and strong financial KPIs that demonstrate traction and growth.

2. How do investors assess SaaS firms using artificial intelligence technology?

The uniqueness of AI algorithms, intellectual property protection, data sources and quality, technology scalability, integration capabilities, and the measurable economic value offered to customers are all factors that investors consider.

3. For investors in B2B SaaS AI firms, which financial metrics are most crucial?

Annual recurring revenue growth, client acquisition expenses, customer lifetime value, churn rates, gross margins, burn rate, and unit economics are key performance metrics that demonstrate growing efficiency as the organization expands.

4. In B2B SaaS AI investment choices, how significant is team expertise?

Investors place a high value on team skills, favouring the creation of teams that combine technical competence in AI and ML, enterprise software experience, industry domain knowledge, and a track record of growing technology companies.

5. How big of a market must B2B SaaS AI firms have to get funding?

Generally speaking, investors seek out addressable markets with a total value of at least $1 billion, as well as substantial proof of market expansion and the startup’s capacity to get a significant portion of the market through better technology and business model implementation.